The calculations were done on the basis of the following formula. The whole matrix has been made on the basis of 2007 figures. The products under consideration, as discussed earlier, are PC (which include desktops and notebooks), Software, Servers, Printers, and IT services. HP’s competitors in this segment are BMC Software, IBM, and CA.įigure 1 shows the BCG matrix for HP’s product offerings. Software: HP’s Software segment provides management software solutions that assist large companies in managing their operations and information technology infrastructure. HP provides a wide range of products and services to its customers and is divided into five business segments:

In this section, we discuss the different products that HP has to offer and its competitors in those segments. Once we have constructed the matrix we will conduct an analysis into the company’s present situation and evaluate them based on their competitors and try to ascertain how effective the BCG matrix is as a tool. To form the BCG matrix we will first study the different portfolios that HP has and their performance over 2007 vis-à-vis their competitors and market leaders.

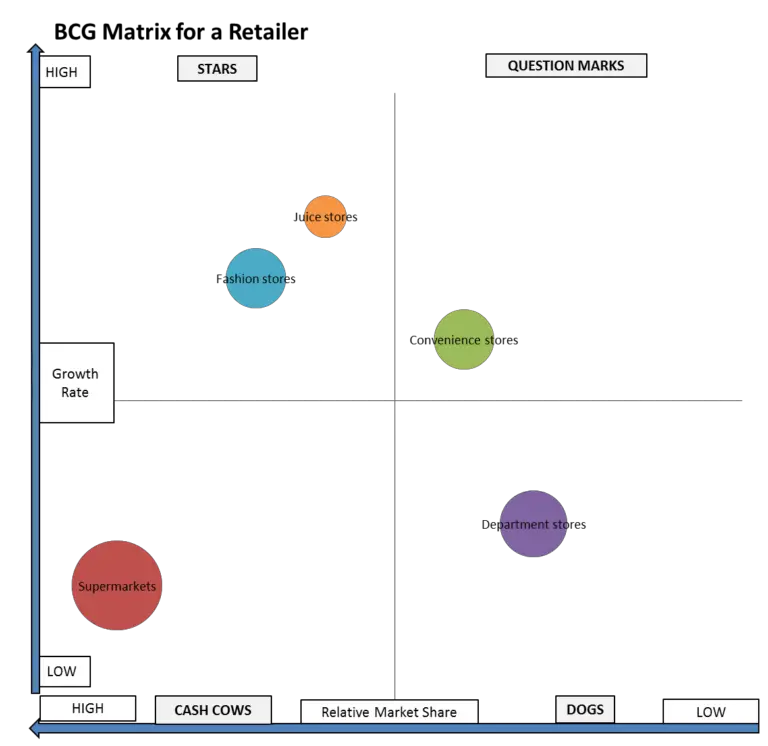

We will use BCG matrix analysis to evaluate HP’s portfolio structure and present situation and then try and find the shortcomings of using this particular tool for portfolio analysis. The company under study is Hewitt-Packard Company (HP). In this way, the same tool highlights those products that demand high investment efforts for low-growth products and that should be avoided. The scope in the long-term is to ensure value creation by combining product offerings while generating the largest amount of cash at the lowest level of capital investment. Hence it may be considered as a useful tool to counteract the substitutes and rivalry forces. The creation of value of a company, following this model, is given from the best composition of the product portfolio. It is recommended to divest/discontinue these products and use the proceeds and savings to turn Question Marks into Stars. They do not generate cash for the company, they tend to absorb it. Dogs: These are products with a low share of a low-growth market.

0 kommentar(er)

0 kommentar(er)